The Overseas Construction Association of Japan, OCAJI announced that the overseas construction orders received by its 52 member companies for the fiscal year 2023 amounted to ¥2.2907 trillion, marking an 11.8% increase from the previous year. The financial results for March 2024 reported by major general contractors also showed a significant rise in overseas orders, reflecting a steady recovery from the economic downturn caused by the COVID-19 pandemic. However, the outlook remains uncertain due to factors such as the situation in Ukraine and fluctuations in exchange rates, as noted by OCAJI.

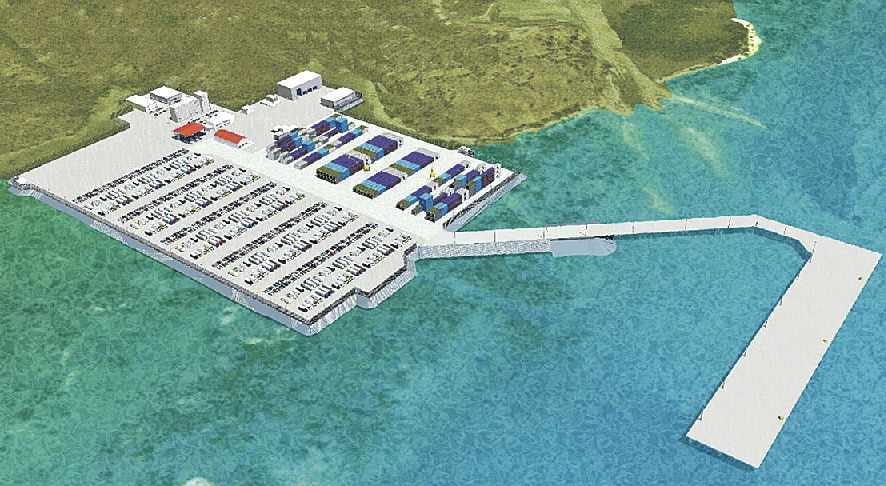

The 2023 order volume for the member companies reached an all-time high. This was driven by substantial orders in North America, particularly for port infrastructure, and a surge in housing demand in Oceania.

Breaking down the figures, orders that Japanese parent companies received decreased by 39.4% to ¥412.2 billion, while those of local subsidiaries increased by 37.3% to ¥1.8784 trillion. Local subsidiaries saw significant growth, with a 227.8% increase in Oceania and a 104.2% increase in Eastern Europe.

In terms of regional distribution, Asia recorded ¥1.0235 trillion, a 9.0% decrease from the previous year, North America: ¥787.8 billion, a 17.9% increase, Oceania: ¥209.4 billion, a 143.8% increase, Eastern Europe: ¥155.4 billion, a 104.2% increase, Africa: ¥50.0 billion, a 79.5% increase, Central and South America: ¥43.1 billion, a 9.0% increase, Middle East and North Africa: ¥17.1 billion, a 2.1% decrease, Europe: ¥4.1 billion, a 53.3% decrease.

North America's growth was driven by large-scale port and hospital construction projects, exceeding the previous year's order volume. In Oceania, the increase in orders for large-scale apartment buildings was a significant contributor. In Eastern Europe, member companies secured numerous contracts for electric vehicle (EV) factories, with Slovakia and Poland being notable markets. Slovakia, which was not in the top rankings for national order volumes in 2022, climbed to the 8th position in 2023. (2024/07/10)